Special Purpose Acquisition Company Spac

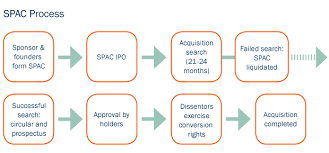

Also called "blank check companies," SPACs usually have two or three years.

Special purpose acquisition company spac. One of the top performing ETFs of is adding a special purpose acquisition company before it finalizes a merger. THE SPAC PRACTICE AT ELLENOFF GROSSMAN & SCHOLE LLP For 25 years, members of the Firm have participated in alternative means of going public. The SPACs (special purpose acquisition companies) market has undergone a transformation over the last few years.

This post provides an update to SPAC structures and transactions since a 18 post (Special Purpose. Not many investors are familiar with special purpose acquisition companies (SPACs), a special breed of IPO stocks that enable well-connected sponsors to raise hundreds of millions of dollars from. SPACs are also called “blank check companies” because they IPO without having any actual business operations.

Special Purpose Acquisition Company (SPAC) is a public trading company that raises its resources from an initial public offering (IPO) aimed at acquiring a new existing company. Blank Check Company Rule 419 imposes various onerous requirements on blank check companies, including prohibition on trading of its common equity until an acquisition occurs While not required, SPAC offerings generally follow the spirit of Rule 419 offerings with a few significant differences. A trusted resource for current information on the Special Purpose Acquisition Company (SPAC) market.

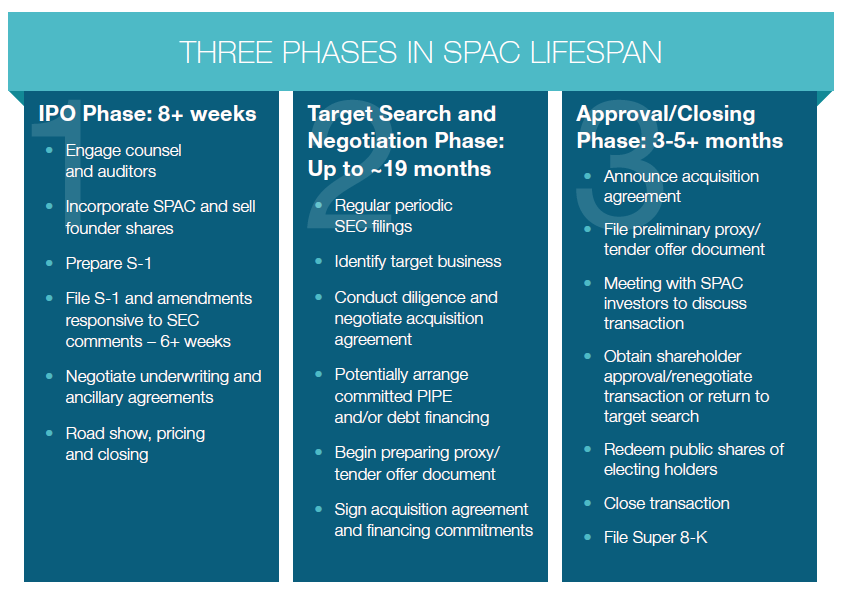

Formally known as a special purpose acquisition company, or SPAC, it’s an investment vehicle that goes public despite having no real business. Listing a SPAC on London Stock Exchange is a straightforward step by step process, beginning with an Initial Public Offering (IPO), that allows sponsors to attract a wide range of. Special Purpose Acquisition Companies (“SPACs”) are companies formed to raise capital in an initial public offering (“IPO”) with the purpose of using the proceeds to acquire one or more unspecified businesses or assets to be identified after the IPO.

Rather, it’s a promise to investors that it will acquire a target company in the future. Capstar Special Purpose Acquisition Corp. A special purpose acquisition company exists to raise money for future acquisitions or mergers.

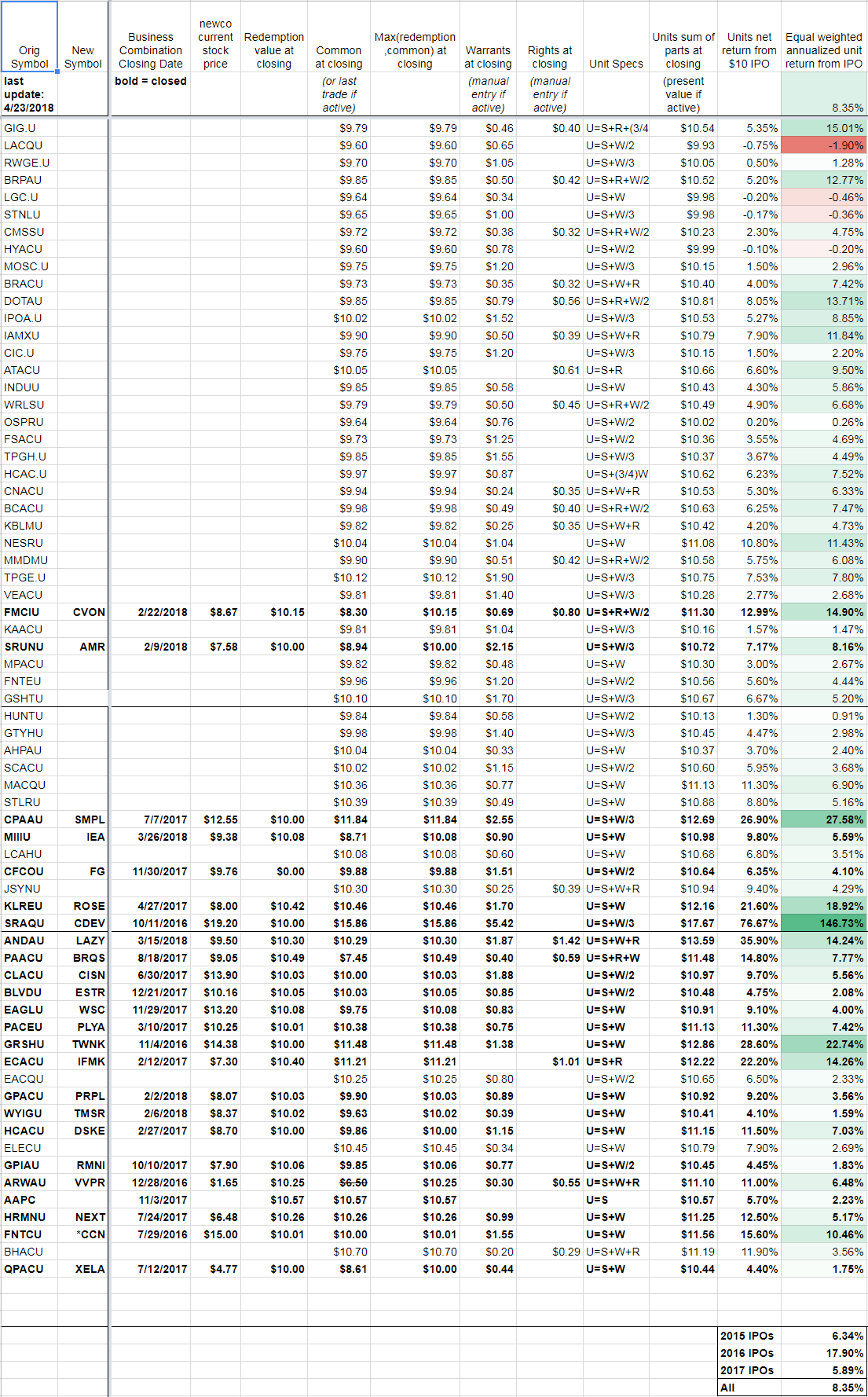

Hedge funds JHL Capital Group and QVT Financial will fold their ownership of MP into the special-purpose acquisition company (SPAC) Fortress Value Acquisition Corp , shares of which gained 9.7% on. SPAC initial public offerings are. Analysis includes total gross proceeds, announcement deadline date (and number of months left until deadline), % held in trust, and list of symbols for all trading securities included in the unit.

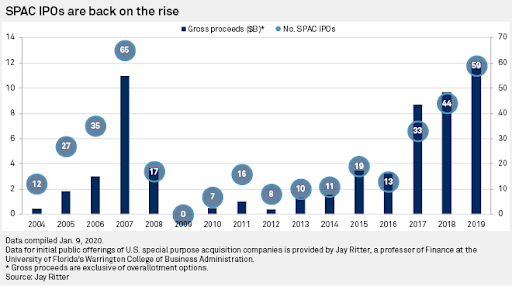

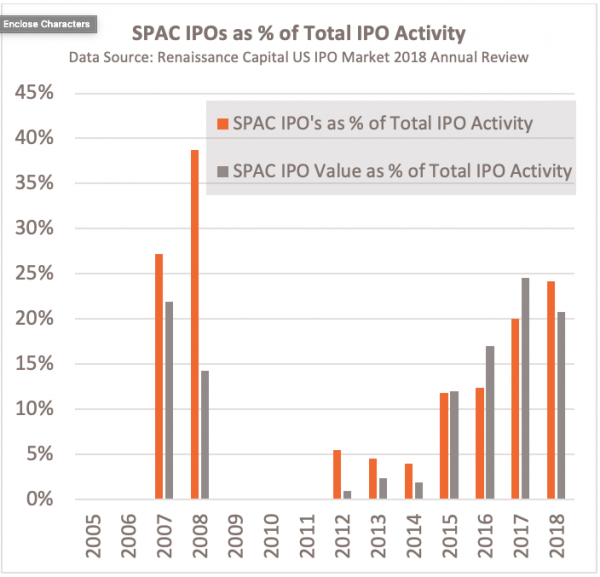

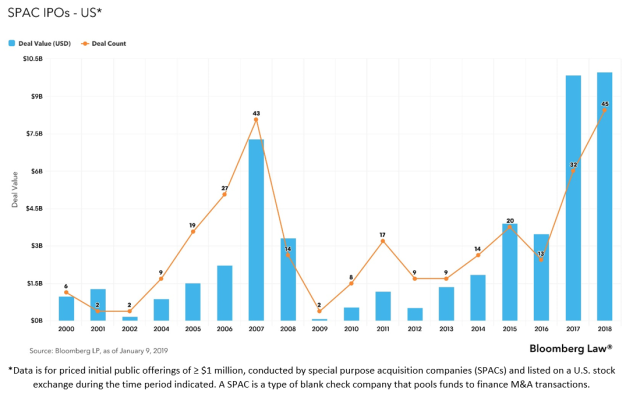

A special purpose acquisition company (SPAC), sometimes called blank-check company, is a shell company that has no operations but plans to go public with the intention of acquiring or merging with a company utilising the proceeds of the SPAC's initial public offering (IPO). A special purpose acquisition company (SPAC) is formed for the purpose of raising capital through an IPO and using those funds to acquire an operating business. SPAC IPOs make up an ever-increasing chunk of the overall US IPO market every year.

“Bet on me” is essentially the pitch that backers of blank-check companies known as special purpose acquisition companies, or SPACs, make to investors. Virgin founder Richard Branson is hoping to raise $460 million to create a new special purpose acquisition company, or SPAC, called VG Acquisition. Or maybe just a little gnawing but nothing major.

With $150mm in trust, we are seeking businesses with enterprise values of $500mm or more that are at vanguard of “industry 4.0”, deploying established technologies in new and innovative ways to transform. Since the SPAC is only a shell company, the founders become the selling point when sourcing funds from investors. The proceeds are used to buy one or more existing companies.

The site includes weekly SPAC IPO updates. Also known as a “blank-check company,” a SPAC is a cash-rich shell company that raises money from investors in an initial public offering and seeks to acquire a private acquisition target over a fixed time period. The way a SPAC works is that the company raises capital in public markets and acquire a private.

Gores Metropoulos, which is listed on the Nasdaq exchange, is a special purpose acquisition company, or SPAC, sponsored by an affiliate of The Gores Group, the global investment firm founded in. Former Goldman Sachs president and economic adviser to President Trump Gary Cohn is the latest high profile figure on Wall Street to join a special purpose acquisition company (SPAC. As Directors get invited to join Boards of SPACs or do.

(SPECIAL PURPOSE ACQUISITION COMPANY ) AN OVERVIEW AND RECENT DEVELOPMENTS. Among other potential moves it is exploring, Quibi is considering trying to raise even more funding or launching an IPO through a merger with a special purpose acquisition company (SPAC), per the. Special purpose acquisition company (SPAC):.

Special Purpose Acquisition Companies (SPACs) are a convenient way of raising finance for a specific purpose, most usually the acquisition of a third party company. (“Capstar”) is a company organized for the purpose of pursuing a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The special purpose acquisition company (SPAC) might be the hot new trend, but it has been around since the 1980s.

Unlike reverse mergers, SPACs typically come with. Special purpose acquisition companies (SPACs) are an underappreciated asset class and present compelling risk/reward opportunities. SPAC is an acronym for special purpose acquisition company.

SPACs bring together experienced management teams, often comprising industry veterans, private equity sponsors or other financing experts who can leverage their expertise to raise. A special purpose acquisition company (SPAC) is a company formed solely to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. The plan is to raise money from investors and use it.

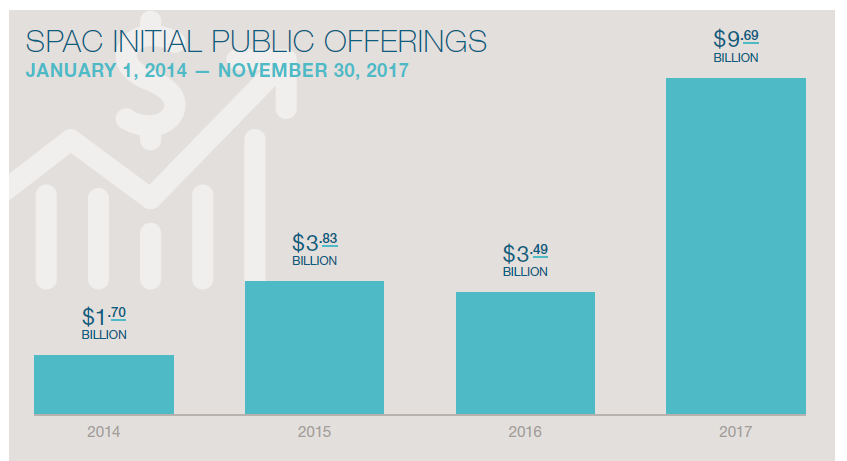

A download-able weekly list of all SPAC (Special Purpose Acquisition Company) IPO transactions. Special Purpose Acquisition Companies (“SPACs”) continue to be increasingly popular vehicles for entities or individuals to raise capital to pursue merger opportunities, and for private companies seeking to raise capital, obtain liquidity for existing shareholders and become publicly traded. A SPAC, also dubbed a blank-check company, is one created solely for the purpose of buying out an already operational company, using the proceeds of an IPO.

One of the very interesting topics Directors are hearing about is a liquidity structure called a SPAC (Special Purpose Acquisition Company). The special purpose acquisition company, or SPAC for short, has become ’s most talked-about investment vehicle. The agreement, announced Friday morning, will combine Porch with PropTech Acquisition Corp., a special purpose acquisition company, or SPAC, as they’re known.

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of. They provide private companies with a. Securities Investor Protection Corporation (SIPC) insures the accounts of our clients for up to $500,000 each customer, subject to limitation of $100,000 from claims for cash balances.

Social Capital Hedosophia II is set to merge with Opendoor at a $4.8-billion. -95+% of net proceeds deposited in escrow -. A special purpose acquisition company is formed by experienced business executives who are confident that their reputation and experience will help them identify a profitable company to acquire.

Simply stated, it serves as a vehicle to bring a private company to the public markets. He is the latest in a line of wealthy investors. A SPAC (Special Purpose Acquisition Company), also known as a "blank check" company is similar, but not identical, to a reverse merger.

Special Purpose Acquisition Companies (SPACs) are publicly-traded investment vehicles that raise funds via an IPO in order to complete a future acquisition. The stated purpose of the company is to identify and purchase a business that's consistent with the investment objectives of the SPAC. GLEO.U, GLEO and GLEO WS) is a newly organized blank check company, (known also as a Special Purpose Acquisition Corporation or “SPAC”), incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses, which.

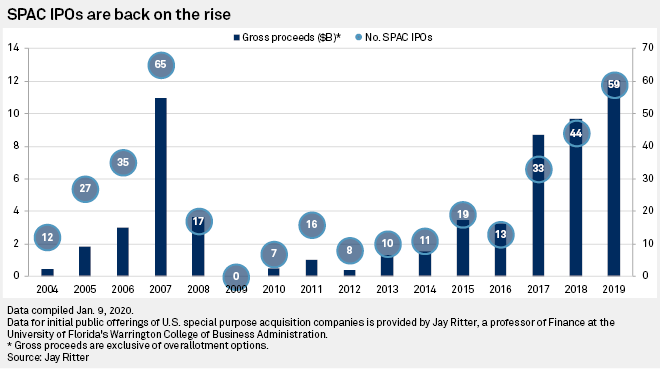

SPAC IPOs make up an ever-increasing chunk of the overall US IPO market every year. Is a member of the FINRA, NQX, MSRB, and SIPC.All securities are offered through EarlyBirdCapital, Inc. It's important to understand the dynamics at work as a SPAC.

Resources raised through IPO of a Special Purpose Acquisition Company (SPAC) are put on the trustee’s hands until SPAC research identifies its merger or opportunity. Rather than going into business for itself, each SPAC. From a distance, a special purpose acquisition company (SPAC) probably falls under that category, but, as we're about to demonstrate, SPAC is an acronym that's all bark and no bite.

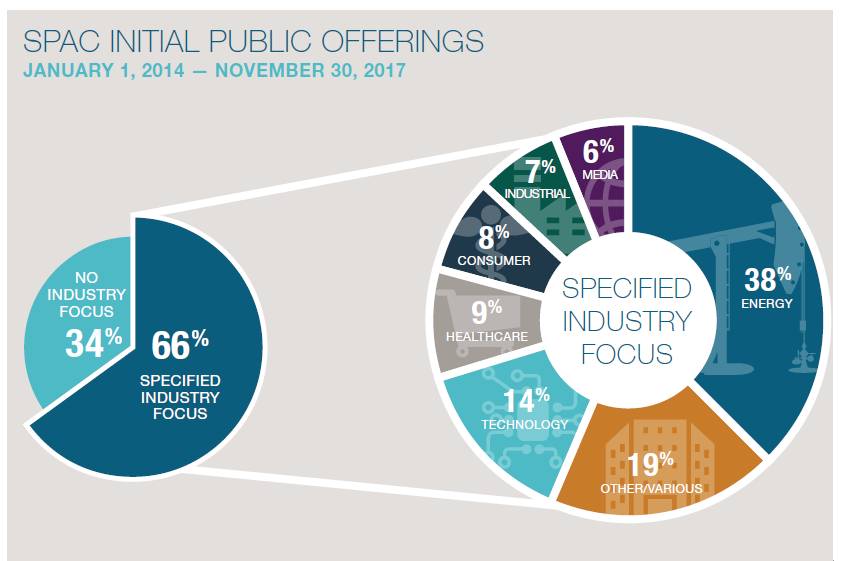

About NHIC SPAC NewHold Investment Corporation ("NHIC") is a Special Purpose Acquisition Corporation ("SPAC") targeting industrial technology companies. DraftKings , Nikola , and Virgin Galactic are among the big names that have used a Special Purpose Acquisition Company (or SPAC) to raise capital and list shares for public trading. Going public via a special purpose acquisition company (SPAC), commonly referred to as a reverse merger process, is another route that’s becoming more popular and is also worth considering.

Such an entity — also called a special-purpose acquisition company, or SPAC — has no underlying assets. In 10,we innovated a new SPACstructure for 57th Street General Acquisition Corp.that is now. A special purpose acquisition company is an entity that's set up specifically as a shell company with no immediate business purpose of its own.

SPACs, or special purpose acquisition companies, go public strictly to raise funds in order to acquire private companies. A special purpose acquisition company (SPAC) is a corporation formed by private individuals to facilitate investment through an initial public offering (IPO).

Going Public Via Special Purpose Acquisition Companies Frogs Do Not Turn Into Princes Sciencedirect

What Is A Special Purpose Acquisition Company Spac Cleverism

Zweck Bedeutung Und Wi Rdigung Von Special Purpose Acquisition Companies Spac Walmart Com Walmart Com

Special Purpose Acquisition Company Spac のギャラリー

Update On Special Purpose Acquisition Companies

Hzj0f9itsoqk3m

Special Purpose Acquisition Companies Spacs Withum

What Is A Special Purpose Acquisition Company Spac Should I Invest In Them Simplemoneylyfe

Spac Pbm

Spac Special Purpose Acquisition Company By Deepak Dahiya

Spac Special Purpose Acquisition Companies Zweck Bedeutung Und Wurdigung German Edition Burghardt Benjamin Amazon Com Books

Spacs Revisted We Said It Wouldn T Be Any Different Bloomberg Professional Services

Pdf Spac Ipos

Just What Is A Spac

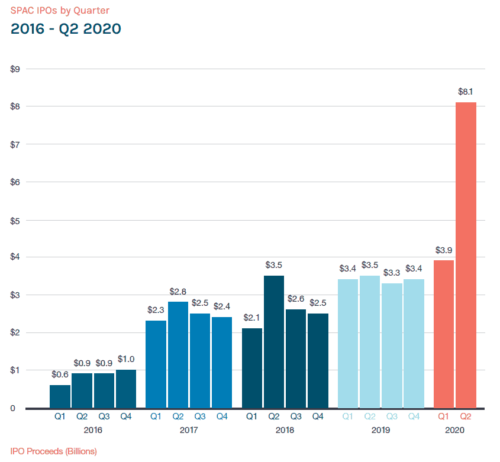

Blank Check Ipo Proceeds Hit New Record In 19 As Wall Street Buys In S P Global Market Intelligence

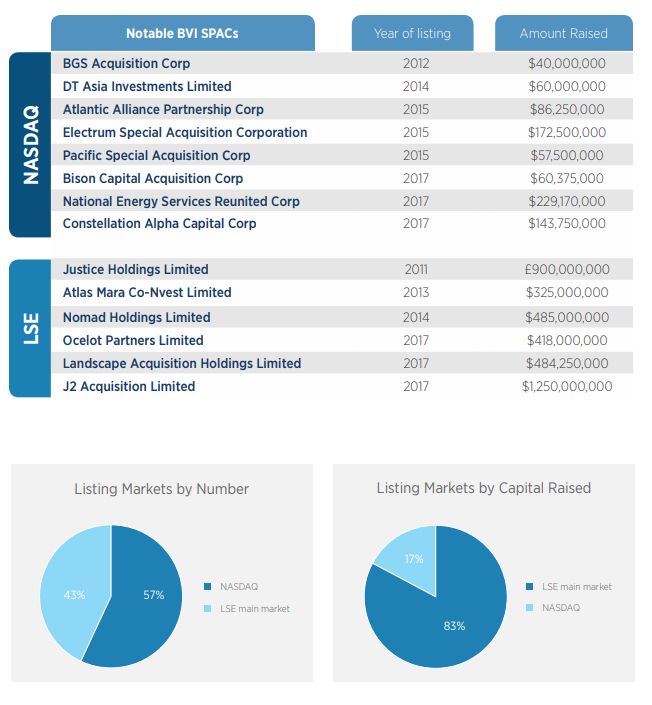

The Rise Of Bvi Special Purpose Acquisition Companies Corporate Commercial Law Bermuda

Perverse Incentives Of Special Purpose Acquisition Companies The Poor Man S Private Equity Funds Sciencedirect

Spacs Composing The Right Board Of Directors For A Spac

Pdf Going Public Via Special Purpose Acquisition Companies Frogs Do Not Turn Into Princes Semantic Scholar

Boom In Blank Check Companies Or Spacs What Investors Need To Know Barron S

Analysis Spac Ipo Market Share Ascends To 30 But Prices Dive

What Is A Special Purpose Acquisition Company Or Spac Thestreet

Special Purpose Acquisition Company Frank S Super Communication

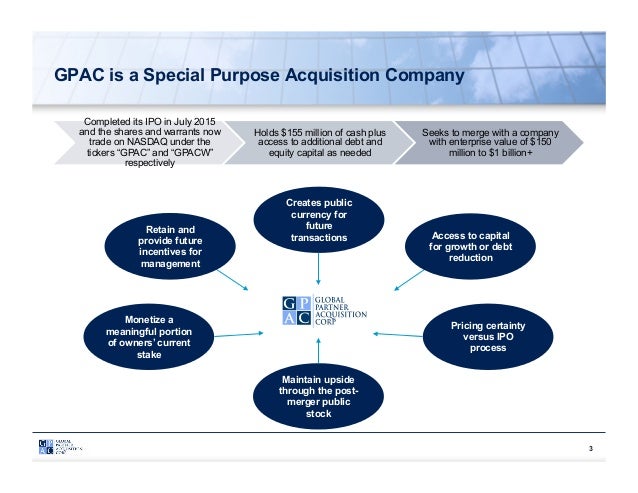

Global Partner Acquisition Corporation Presentation

What Is A Spac Here S Everything You Need To Know The Stock Dork

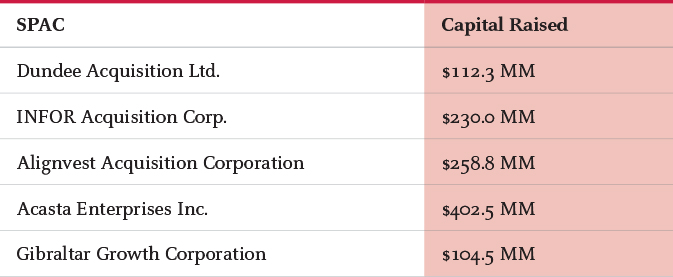

Spac Offerings In Canada Will Will See More

Another Sign Of Frothy Markets Blank Check Boom Wsj

Eg0qihproghjhm

Spac Ipo Listings On Nasdaq Nasdaq

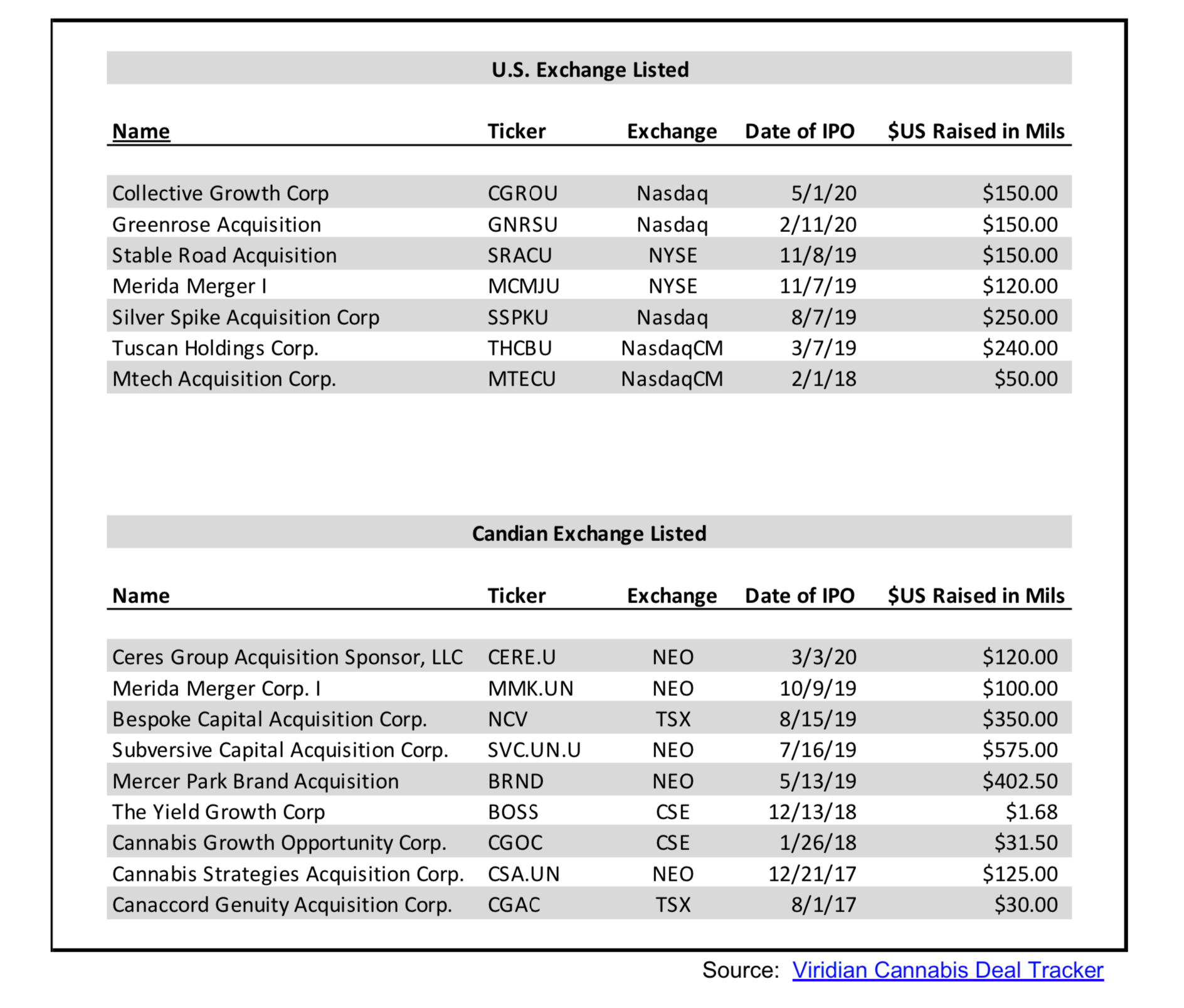

The Emergence Of The Spac Special Purpose Acquisition Corp In The Cannabis And Hemp Industries

What Is A Blank Check Company Or A Spac Activeallocator Com Blog

Invest In Startups Equity Crowdfunding Microventures

6 Spacs To Buy For Smart Money Returns Kiplinger

The Rise Of Bvi Special Purpose Acquisition Companies

Spacs Investing In Acquisitions Ipo Capital Raising

Spac A New Frontier Of Private Equity Investment Bspec

Update On Special Purpose Acquisition Companies

Lidar Startup Luminar To Go Public Via 3 4 Billion Spac Merger Techcrunch

Freethinker Investor Investment Special Purpose Acquisition Company Spac Ipo

The Spac Race Wall St Banks Jostle To Get In On Hot New Trend Financial Times

Patrick Byrne Levered A Spac Create Cryptocurrency Kingdom

Special Purpose Acquisition Companies An Introduction

Gcm Grosvenor Merges With Spac To Go Public Chief Investment Officer

Special Purpose Acquisition Companies Spac S Funding Blind Pools Mature Unicorns Family Owned Businesses During The Great Corona Crisis Gcc Australian Standfirst

The Art Of Spac Arbitrage Julian Klymochko Seeking Alpha

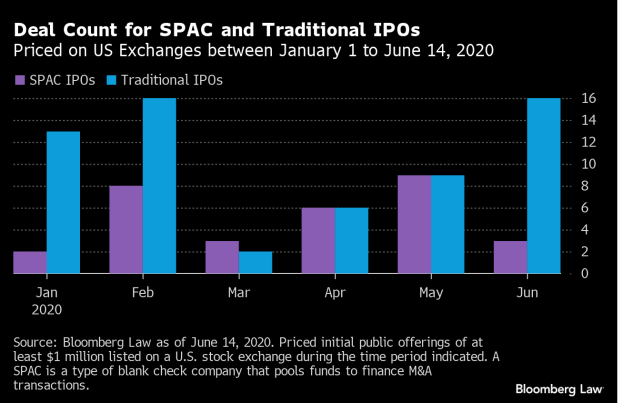

Analysis Fortunes Of Spac Traditional Ipos Diverge In Pandemic

The Special Purpose Acquisition Company Spac Or Private To Public Equity Ppe Initiative Gigcapital

Investors Love Spacs Blog

Amazon Com Spac Special Purpose Acquisition Companies Zweck Bedeutung Und Wurdigung German Edition Ebook Burghardt Benjamin Kindle Store

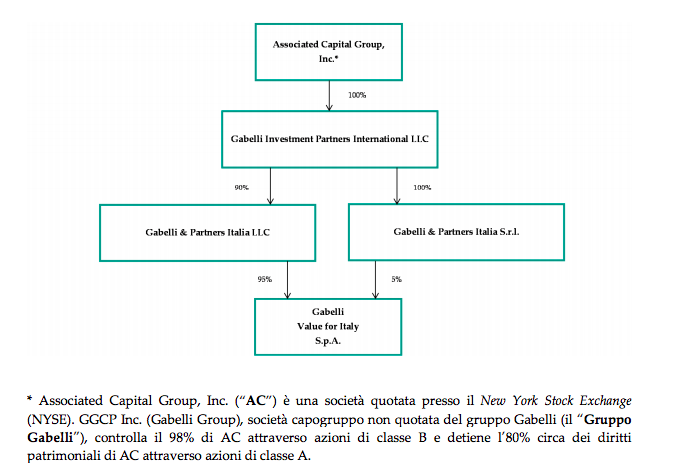

Gabelli S Spac Lists Today At Aim Italia After Having Raised 110 Mln Euros From Investors Bebeez It

Special Purpose Acquisition Companies Capabilities Vinson Elkins Llp

Video Special Purpose Acquisition Company Explained By Lincoln W Daniel Bullacademy Org Medium

Spac Special Purpose Acquisition Corp By Acronymsandslang Com

1

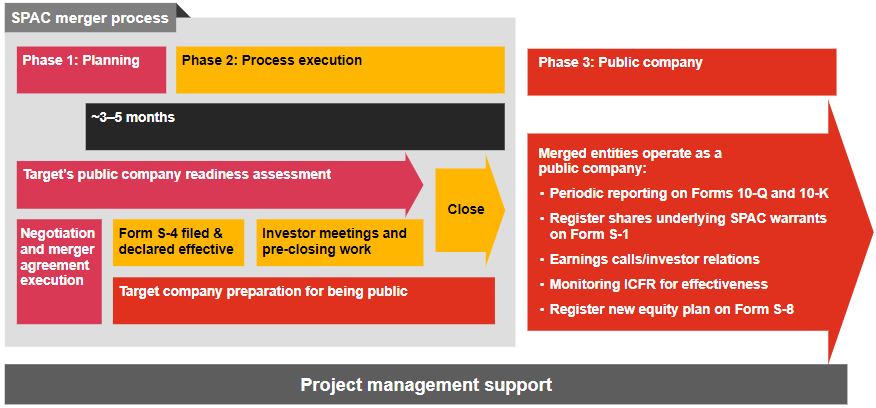

How Spac Mergers Work Pwc

Blank Check Ipos Hit New Record Wsj

Special Purpose Acquisition Company Fin Pol

18welovcoskb M

Special Purpose Acquisition Companies An Introduction

Earning The Premium A Recipe For Long Term Spac Success Mckinsey

The Specs On Spacs And Why They Get Backing Pymnts Com

A Primer For Going Public Via Spac By Baris Guzel The Startup Medium

Pdf Specified Purpose Acquisition Companies In Shipping

Spac Special Purpose Acquisition Corporation Ppt Video Online Download

Special Purpose Acquisition Companies Why Spacs Are Hotter Than Ever The Motley Fool

o Knows Spacs Understanding Special Purpose Acquisition Companies

Spacs Ipo Explained Special Purpose Acquisition Company Youtube

Special Purpose Acquisition Company Database Spac Research

What The Spac A Quick Primer On A Trending Exit Path By Dakin Sloss Prime Movers Lab Aug Medium

A Primer On Spacs Seeking Alpha

Porch To Go Public At 523m Valuation In Spac Deal Marking New Era For Real Estate Tech Company Geekwire

Special Purpose Acquisition Company Spac Overview How It Works

Special Purpose Acquisition Company Database Spac Research

Nasdaq Bets On Blank Check Co Ipo To Boost Listings Spacs Are Sizzling

Here S The Hottest Spac In The Markets Today I Call It Tesla 2 0 Investing Whisperer

Analysis Outer Space Is The Limit For Spac Ipos

Spac Special Purpose Acquisition Company Withum

Alyi Stands Out Among Electric Vehicle Ipos And Spacs 08 31 Press Releases Stockhouse

Special Purpose Acquisition Company Spac Merger Arbitrage Limited

What Is A Special Purpose Acquisition Company Or Spac Thestreet

Another Peak Alert The Blank Check Spacs Boom Has Just Surpassed 07 Zero Hedge

Demystifying Special Purpose Acquisition Companies

Special Purpose Acquisition Companies An Introduction

Spac Special Purpose Acquisition Corporation

Privateraise Spacs

Spac Ipo Listings On Nasdaq Nasdaq

10 Spac Ipo Stocks To Buy As They Grow In Popularity Investorplace

What Is A Spac The Rise Of Blank Check Companies Explained Business Insider

Spac Definition Special Purpose Acquisition Company Abbreviation Finder

Special Purpose Acquisition Companies An Introduction

Once Derided Special Purpose Acquisition Companies Go Mainstream Amid Turbulent Markets The Real Economy Blog

What Is A Spac Ipo Definition And Examples Investment U

A Thriving Financial Product Despite A Record Of Failure The New York Times

Special Purpose Acquisition Company Spac Increasingly Embraced By Biotech Investors

Spacs In The Cannabis Industry

Electric Vehicle Makers Find A Back Door To Wall Street The New York Times

What Is A Special Purpose Acquisition Company

Freethinker Investor Investment Special Purpose Acquisition Company Spac Ipo

Special Purpose Acquisition Company

Spac Special Purpose Acquisition Company By Acronymsandslang Com

What S Special About Today S Special Purpose Acquisition Companies

Spacs What S A Special Purpose Acquisition Company